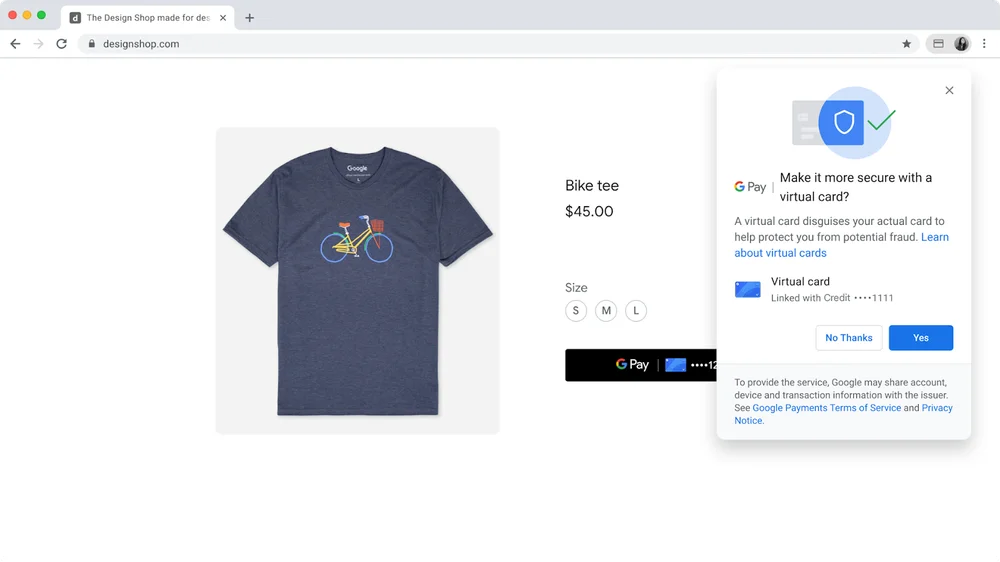

Online shopping has become increasingly popular in recent years. However, consumers continue to be concerned about the security of their credit card information. With the increasing number of online retailers, it is becoming increasingly difficult to ensure the security of your personal payment information. Google’s virtual cards come into play here.

According to Google Pay Director of Product Rajiv Appana, the virtual card system is intended to make online payments safe, simple, and secure. The Google Pay platform’s autofill feature allows users to fill out payment information with a single click.

Google created virtual cards in response to security concerns.

A virtual card is a one-of-a-kind card number that takes the place of your actual credit card number. Because the virtual card number is not your actual credit card number, your money is safe if it is stolen. This also safeguards you against potential fraud. Google also employs two-factor authentication to verify the user and ensure the virtual card’s security.

When you choose the virtual card option in the autofill, Google Pay will use machine learning algorithms to retrieve the virtual card information from your bank and fill out the seller’s site for you. This feature is also useful when paying at a restaurant that accepts QR codes.

Virtual cards are currently available to anyone who has a Capital One or American Express credit card. Google is also working to include Visa, Mastercard, and other major banks. Collaboration with innovative partners across the payment ecosystem has been critical in bringing this technology to life.

Google’s virtual card system is a safe way to keep your credit card information safe while shopping online. It is simple to use, and you can sign up using any eligible credit card. As the world continues to shift towards a more digital space, having secure payment options is critical. Virtual cards are a fantastic solution to this issue.